You may have watched the popular show on Netflix, Bling Empire. It is no doubt that we aspire to be someone like Anna Shay, Christine Chiu, and Kane Lim.

They live lavish lifestyles and own lots of branding clothes and apartments, and some of them even have a private jet.

This lifestyle might seem impossible to have, but many young Singaporeans are actually working towards it.

Young S’poreans Want to Retire With $6,000 Monthly Expenses With a High-End Car & Private Property

Young people certainly have big dreams, as reported in the OCBC Financial Wellness Index survey, to access Singaporeans’ financial wellness.

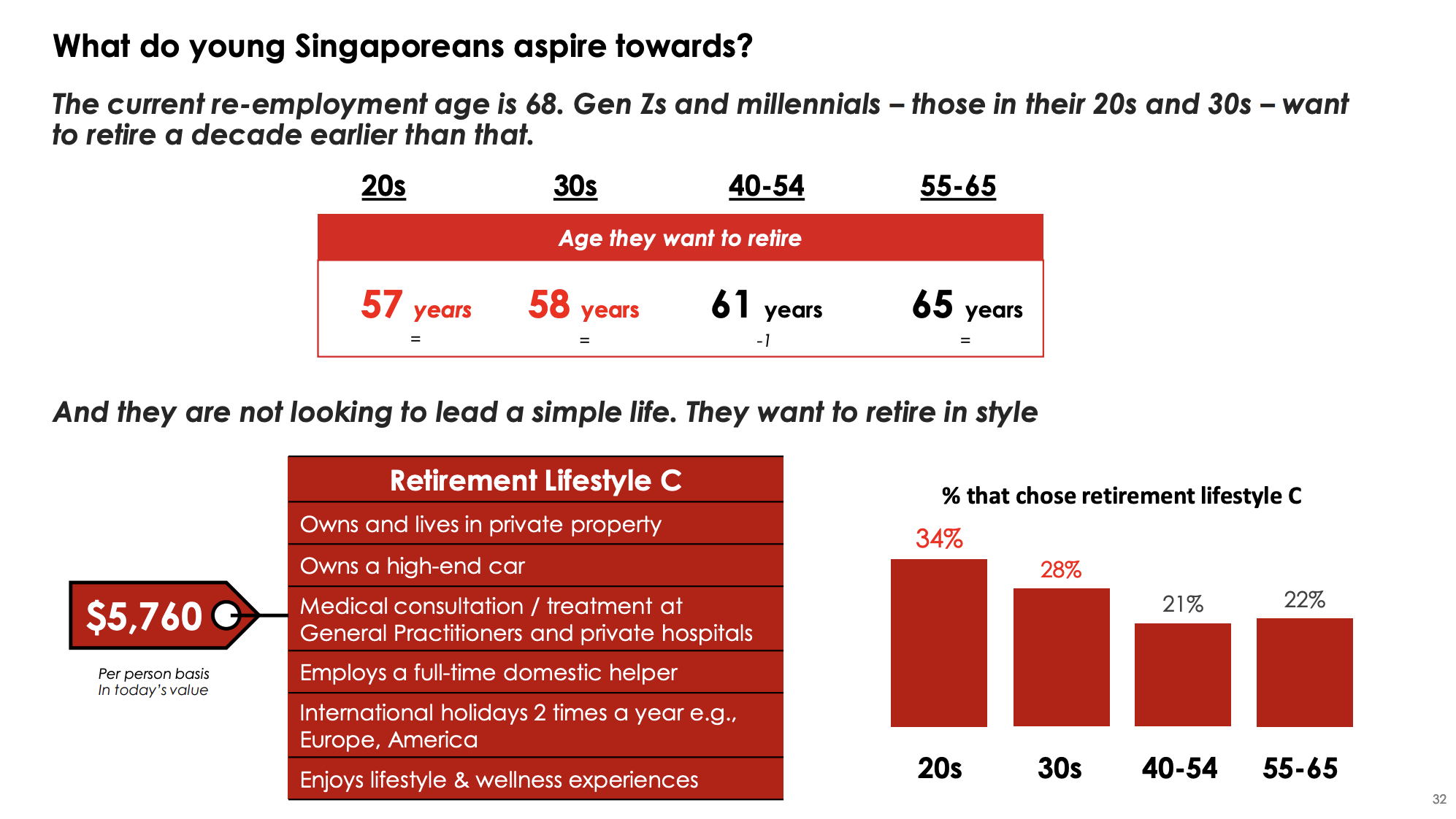

Despite the inflation situation in 2022, Gen Zs and millennials, those in their 20s and 30s, want to build their retirement nest eggs quickly and live a lavish lifestyle.

This includes living on private property, owning a high-end car, and traveling around the world to expensive countries.

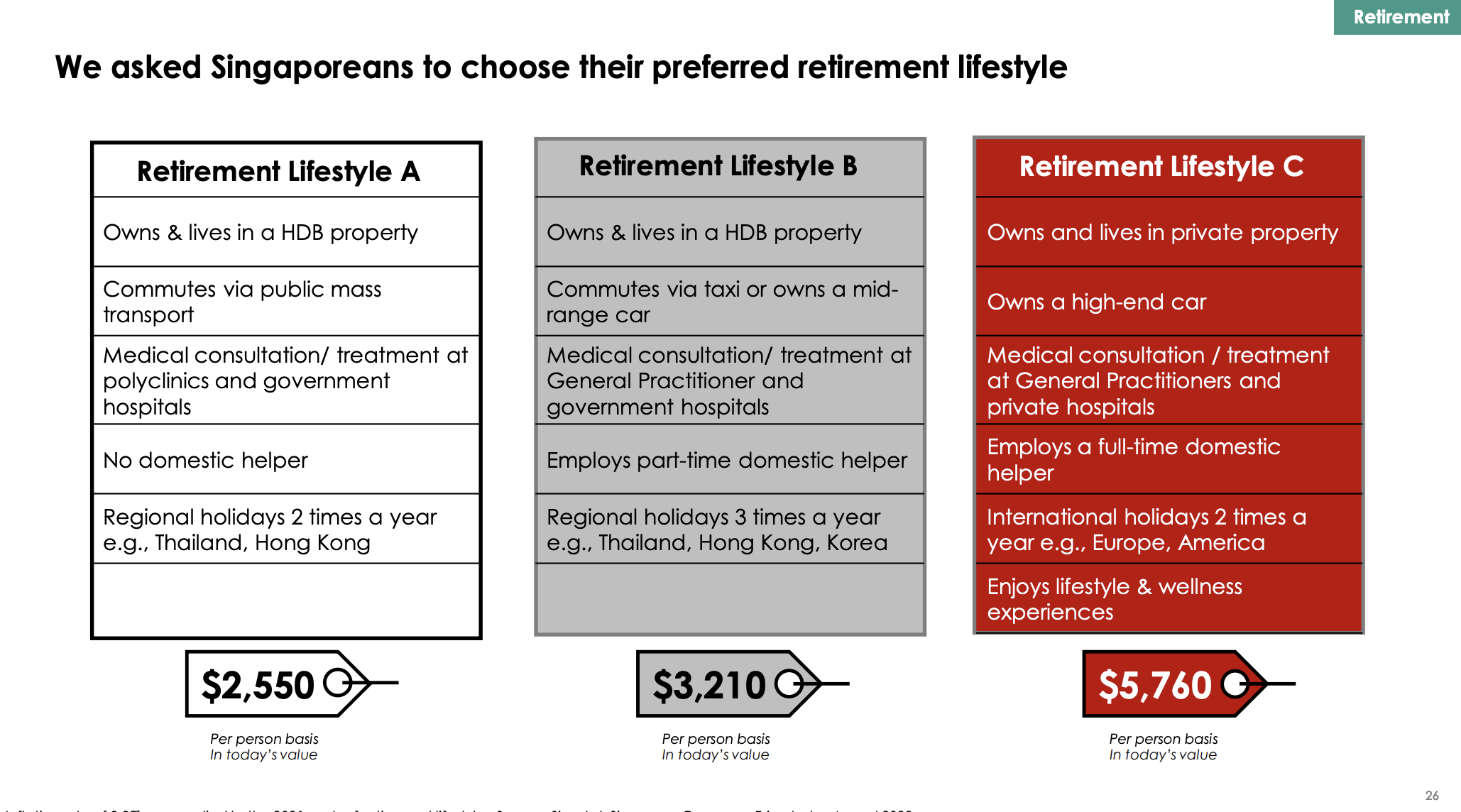

As you can see from Retirement Lifestyle C, it requires about S$5,760 per month. Compared to what the older generations prefer, they only need about S$2,550 per month.

The older generations are contended with living in an HDB flat, commuting via public transport, and having no domestic helper.

Furthermore, Gen Zs and millennials hope to retire a decade earlier than those aged 55 to 65.

What Exactly is the OCBC Financial Wellness Index & How is The Study Conducted?

This study was launched back in 2019 and included a set of comprehensive questions to determine one’s financial health state.

Based on some trends in the previous years, it is found that Singaporeans were good at saving but did not grow their wealth. In 2020, they found that Singaporeans struggled to pay off their loans and plan for retirement due to the pandemic. Last year, Singaporeans were adopting better financial habits.

This year, due to inflation, there is a negative impact on Singaporeans’ financial wellness. This includes losing track of their way to retirement, increased debt stress, and poorer investment returns.

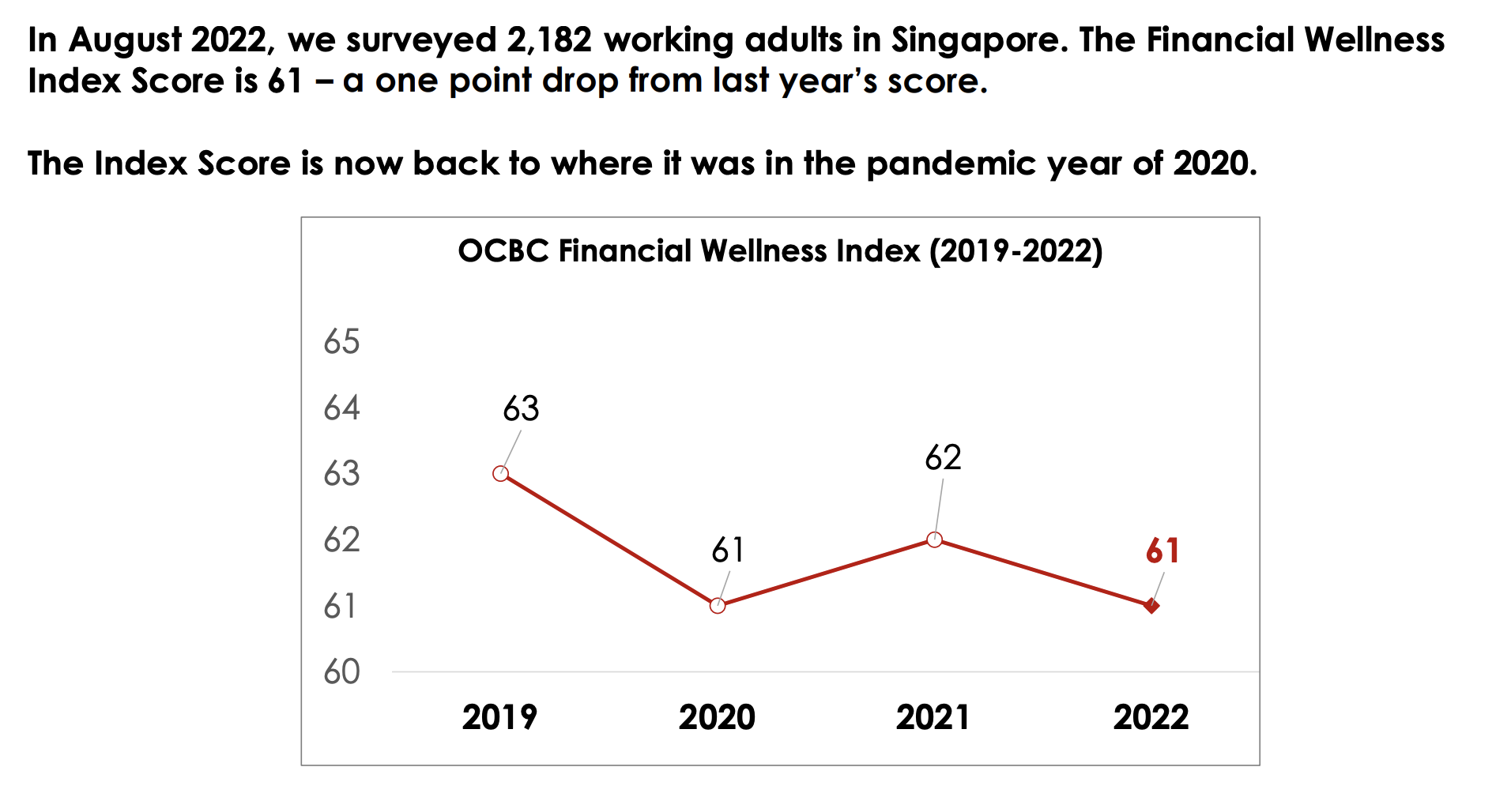

In August 2022, a total of 2,182 working adults in Singapore aged 21 to 65 were surveyed. The Financial Wellness Index Score is 61, a drop from 2021.

Here is a chart to show the score trends over the years.

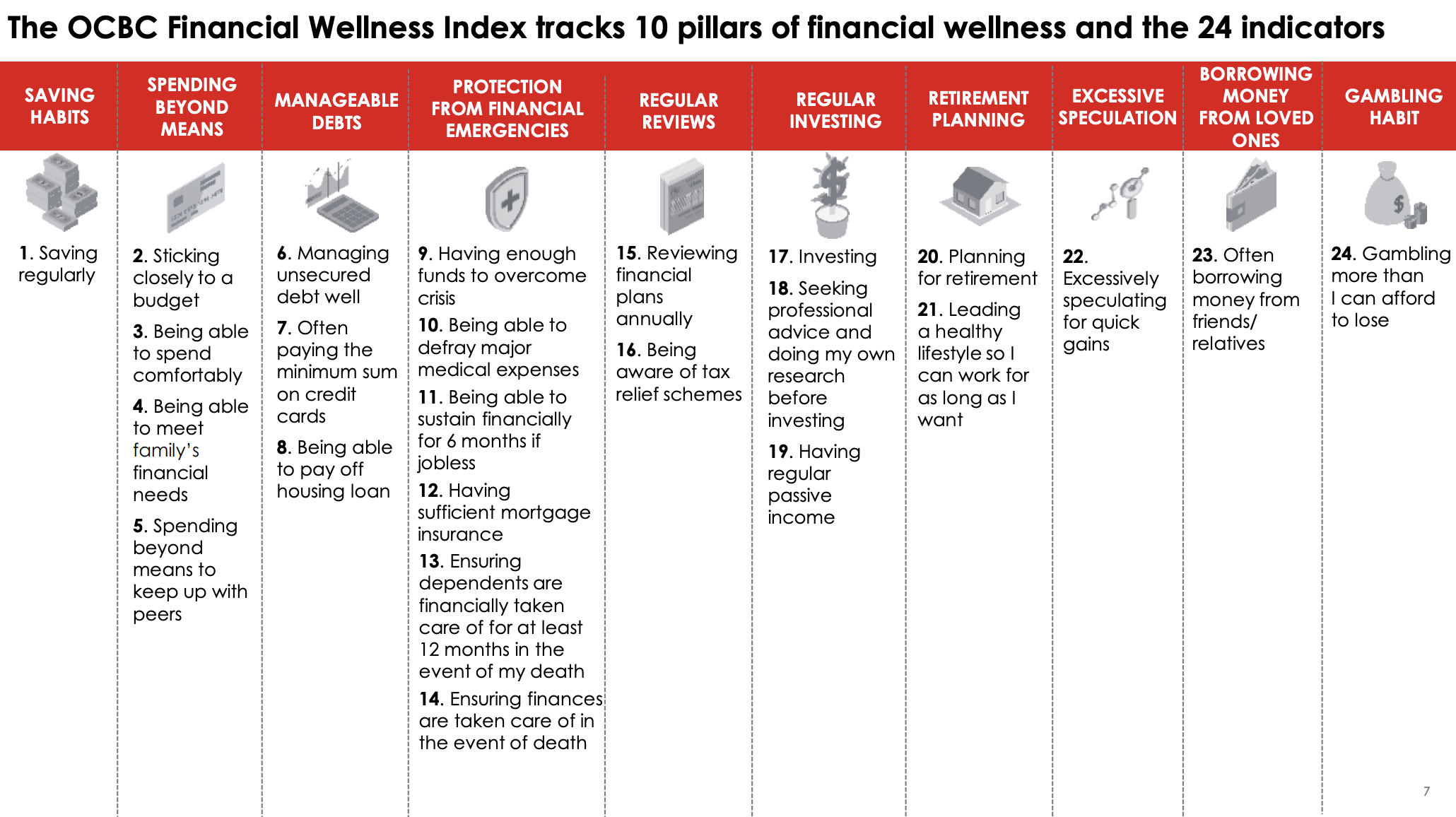

The results are based on these 24 financial indicators.

Other Key Statistics of the Study

Here are the key findings of the OCBC Financial Wellness Index 2022.

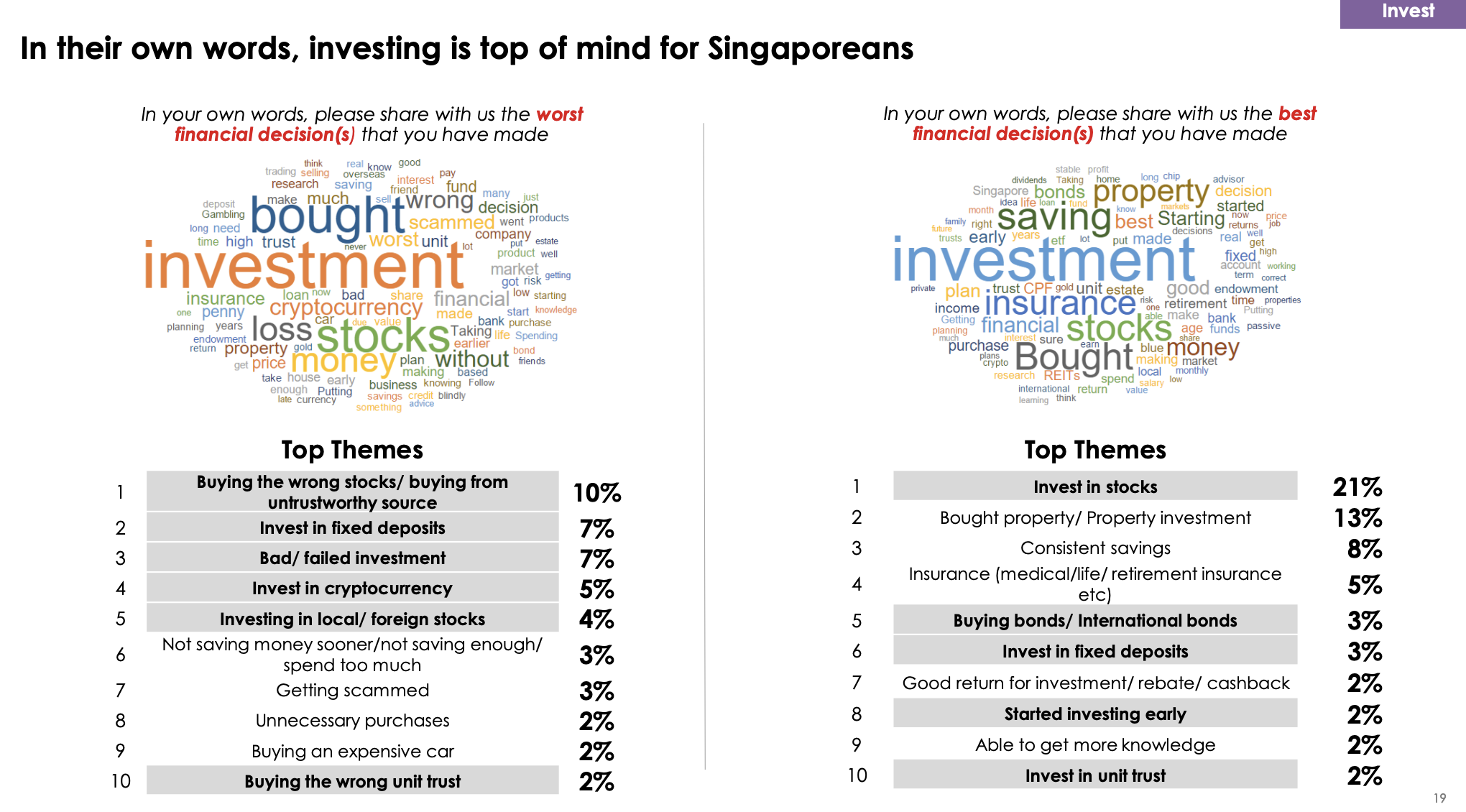

When it comes to how to accumulate their wealth, investments come to their minds. Ironically, this decision can go both ways for people, with 10% of them putting it as their worst financial decision and 21% saying it is the best.

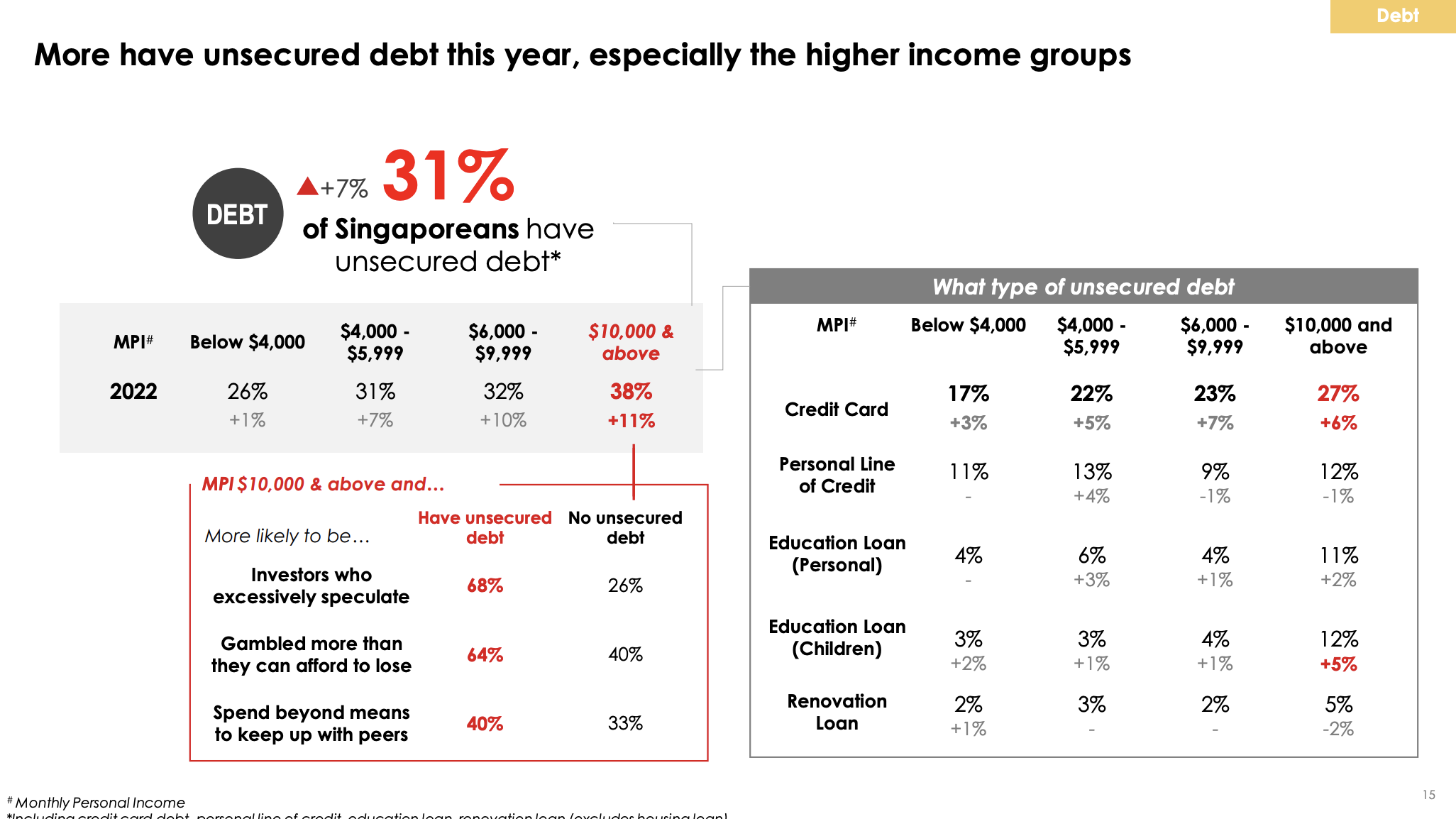

Some of them apparently spend beyond their means to compare with their peers— like how many Gucci bags they have in their wardrobe.

Others gamble more than they can afford to lose and try to predict their investment gains but fail.

This all leads to them having unsecured debts.

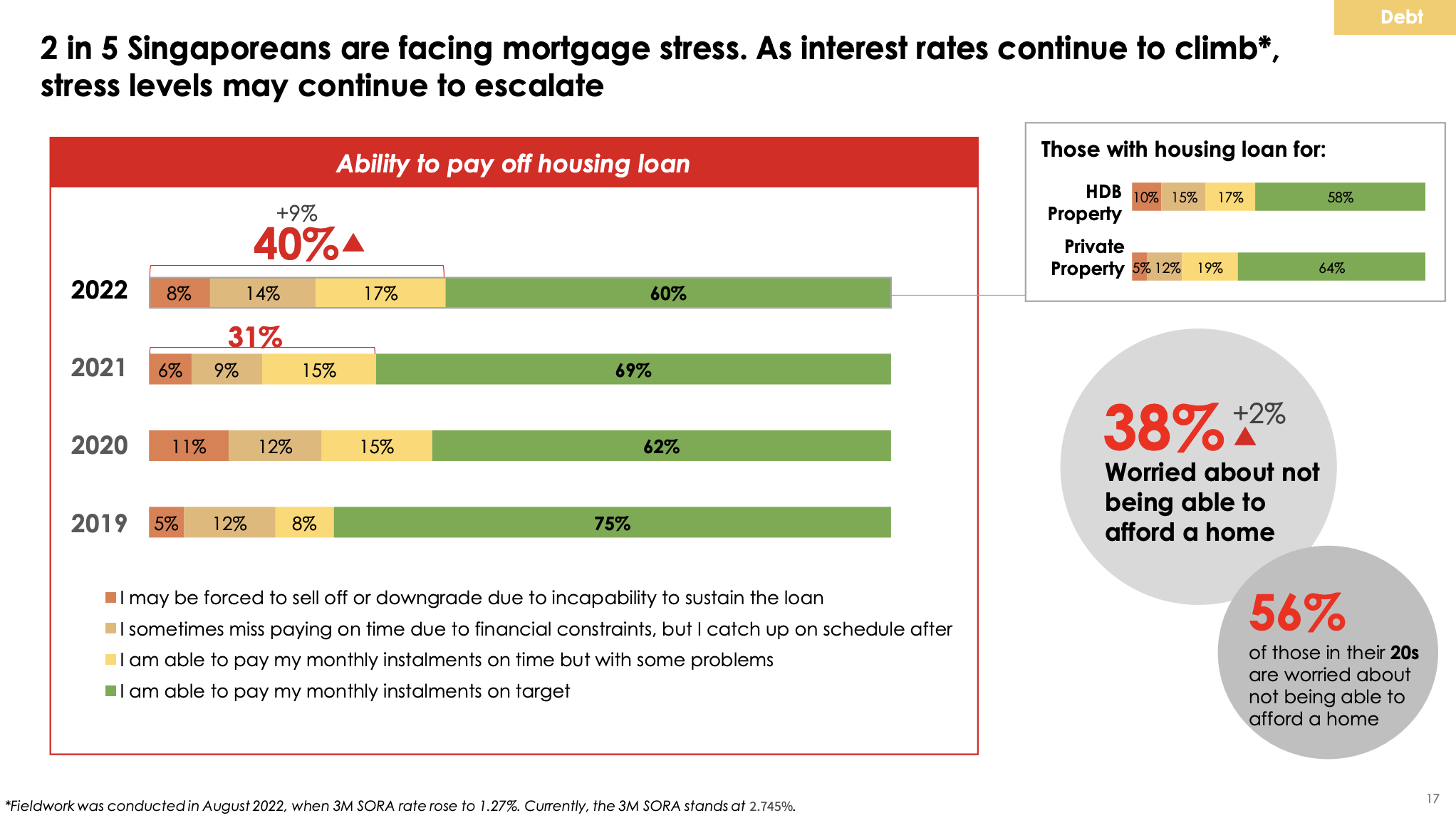

It is also found that two in five Singaporeans face mortgage stress. As we all know, housing in Singapore is extremely expensive, so 56% of those in their 20s are afraid about not being able to afford a home.

What they Are Youngsters Doing To Achieve their Goals?

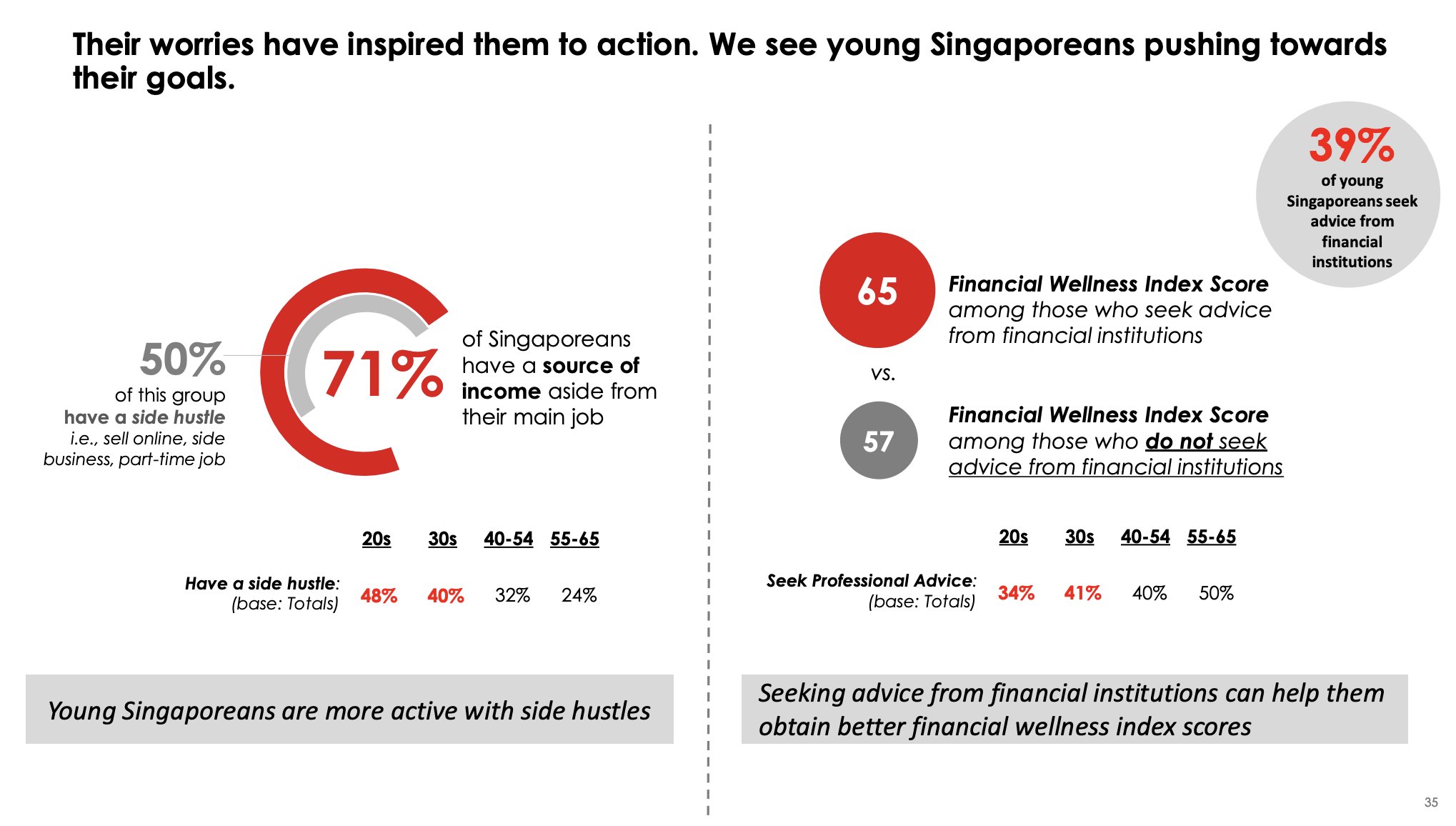

Although you may think young people in Singapore have unreasonable goals, they have ways of attaining the target.

One example is having a side hustle, such as an online business or a part-time job. So, your colleague sitting next door could be a full-time accountant but a part-time caifan store assistant.

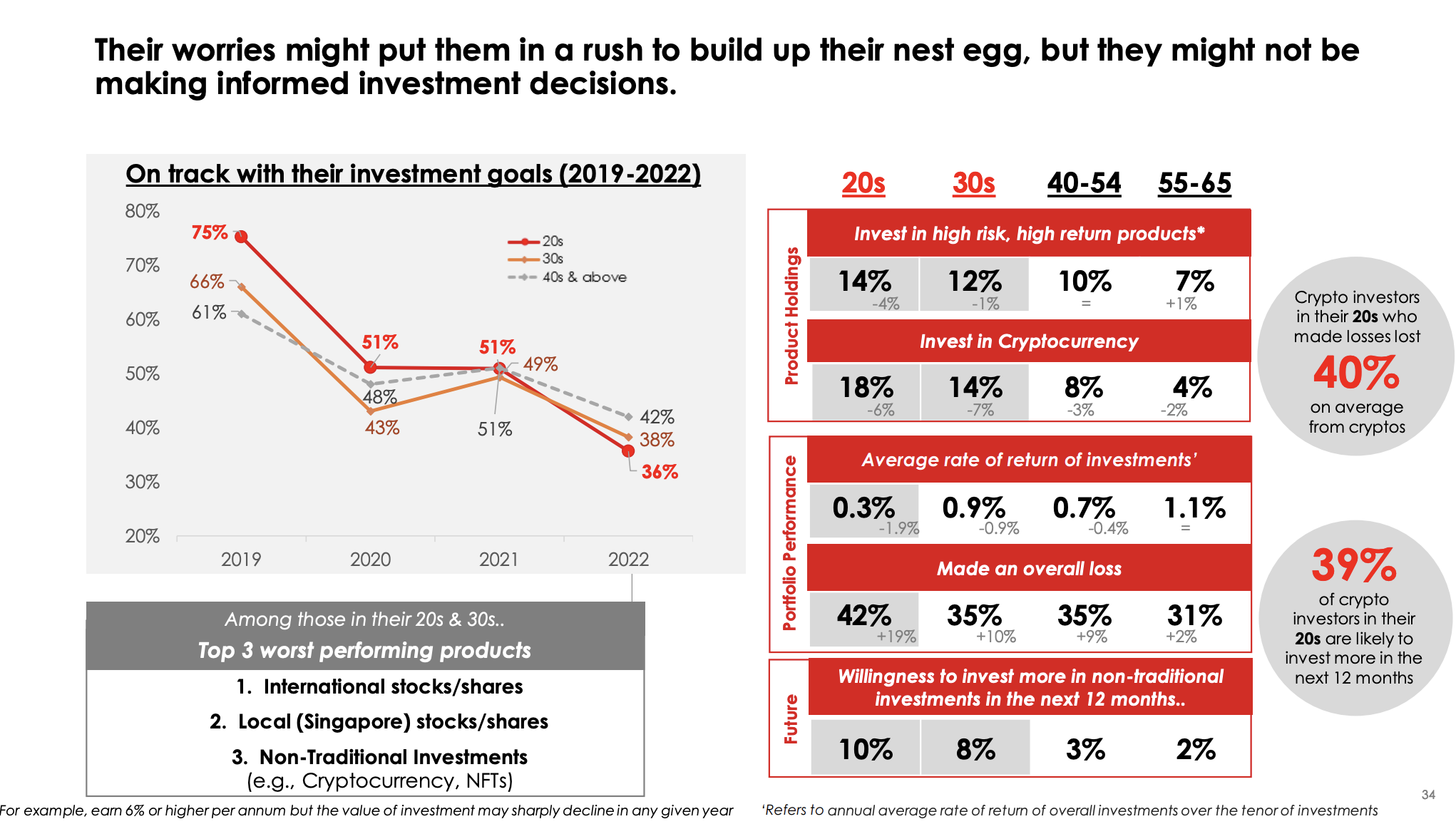

Another way they are using cryptocurrency investments. Although the risks are high, the returns are high as well. Despite being risky, 39% of crypto investors in their 20s are likely to invest more in the next 12 months.

Go big or go home, they say.

But of course, the authorities are making sure that they don’t burn their finger; watch this to the end to know more about Singapore’s proposed new rules for cryptocurrency investment:

Financial Tips to Ensure Financial Wellness

OCBC has given several tips on financial wellness.

Firstly, they recommend Singaporeans save up. Quite straightforward—if you earn S$3,000 a month, you should aim to save at least 10% of your income.

In addition, have at least six months of your monthly expenditure for emergency funds. Do not spend more than what you can, and try to stay debt-free.

Secondly, make informed investment decisions. As the saying goes, do not put all your eggs into one basket. Continuously diversify your portfolio and seek professional advice if needed.

Lastly, they also enforced the importance of insurance. Medical bills are not cheap, and you will never know when you will need them.

Featured Image: joyfull / Shutterstock.com