Lest you didn’t know, DPM Heng spoke about Budget 2021 this afternoon, and it could well be his longest speech ever.

There’s a lot to absorb, so we’ve broken down the ten most important facts here, and also published one article that’ll affect people like you and me.

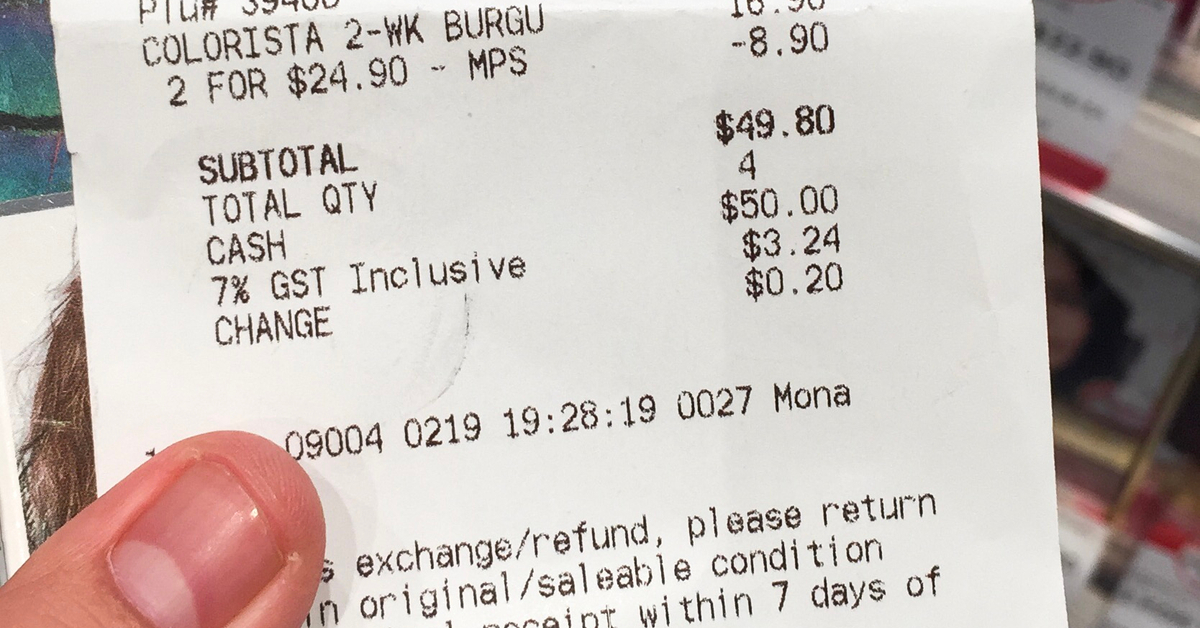

And today, our dear Finance Minister also touched on GST, and while its effects won’t be felt in the near future, its impending arrival is inevitable.

Reader Bao: Are you trying to hit your word count? And is the Gahmen going to remove GST?

Of course not. We’re talking about the hike.

Everything About GST Mentioned in Budget 2021 That You Should Know About

But before that, let’s look at something more pressing: would we be getting any extra GST vouchers?

Yes and no.

If this is confusing, you might want to watch this video to the end first:

After watching this, you’d know that disbursement of the voucher is a yearly affair to offset the GST we pay (not to offset the increase), and it comes in three variants: cash, utility bills rebate and MediSave top-up.

For this year, it’s a tad different: for eligible lower-income Singaporeans, they’ll receive an additional $200 in cash, and an additional 50% of GST Voucher – U-Save.

There won’t be any change in the MediSave top-up.

So if you’ve been receiving benefits from the GST Voucher scheme every year, you’d receive slightly more this year.

With this bigger ang bao, you’d wonder there’s any GST increase.

Thankfully, no. Not yet.

But DPM Heng addressed the elephant in the room: the planned GST hike, which’ll increase GST from 7% to 9%, will still be implemented between 2022 to 2025.

Advertisements

And it’ll come “sooner than later”.

He said, “We will not be able to put off the increase for too long. We will have to make the move some time during 2022 to 2025, and sooner rather than later, subject to economic outlook.”

It’s already been announced earlier that the increase won’t be implemented this year.

“While we are fortunate to be able to tap on our reserves to respond to the Covid-19 crisis, it is not tenable for the Government to run persistent budget deficits outside periods of crisis,” he added.

To understand why there’s a need to increase GST (which was announced back in 2018), watch this video to the end (and please subscribe to our YouTube channel for more informative videos!):

Before you get triggered, remember: foreigners residing in Singapore, tourists and the top 20% of resident households are estimated to account for more than 60% of the net GST borne by households and individuals.

In other words, the rich people are paying a bulk of the GST, and the lower-income residents have support with the GST Voucher scheme.

But there’s one GST that’ll affect all of us.

Advertisements

GST to be Imposed on Items Bought Online That’s Imported by Air or Post

Do you buy things online? And do you Taobao often?

If so, be prepared to cry from 2023.

Currently, if you buy anything less than $400 from overseas that’s imported in via post or air (most items are unless you can wait months for your items), you won’t need to pay any tax.

Now, this is unfair to the items you bought online locally, since all locally sold items would have GST (even if the seller didn’t break down the price, it’d have been included in the selling price).

So, with water bottles made in Singapore crying “racist!” and “unfair!”, all water bottles imported from air or post overseas would need to be taxed.

Advertisements

Actually, all items flying into Singapore would be taxed. We’re just using a water bottle as an example since water bottles can talk.

Before ships cry “racist!” and “unfair!”, do note that all items that are shipped in are already taxed; your forwarder might have included the GST in the price breakdown.

Reader Bao: So this GST isn’t related to the GST hire?

Not really. Instead, it’s to level the playing ground between overseas sellers and local sellers. DPM Heng said, “One aspect of a fair and resilient tax system is ensuring a level playing field for our local businesses vis-a-vis their overseas counterparts. This is especially relevant as e-commerce for sales of goods and services, is growing.”

So your cheap Taobao water bottle might no longer be that cheap soon.

Advertisements

After all, remember: GST is scheduled to increase to 9%.

Featured Image: Siew Chui / Shutterstock.com